I like to tell my clients that Florida is best described to drivers as a “protect-yourself-state.” Unfortunately, insurance is big business, and insurance companies are in the game to make money. One way insurance companies make money (because trust me, they get away with an awful lot of swindling) is by BONUSING insurance agents who leave their clients unprotected by failing to explain the importance of Uninsured/Underinsured Motorist Coverage (UM).

I’ve recently joined forces with a local insurance agent and we’re hoping to plan and host seminars to help Florida drivers better protect themselves. In the meantime, I want to spread the word to anyone and everyone who can hear me.

When it comes to injuries sustained in an auto accident, Florida law requires drivers to carry only one type of insurance: Personal Injury Protection, (PIP). Florida drivers are required to pay premiums for $10,000.00 in PIP coverage, and have the option to extend their PIP coverage. PIP applies to every single driver on the road, and is available to its insured regardless of fault in an accident. IE: You are involved in a crash caused by someone else – you seek medical treatment, which is billed under YOUR OWN PIP. -OR- You are involved in a crash you’ve caused – you seek medical treatment, which is billed under YOUR OWN PIP. However, Florida law does NOT require that you carry insurance to reimburse OTHER drivers on the road for their medical bills, lost wages, pain and suffering, future damages, etc. should you cause an accident. It would stand to reason, then, that Florida law does not require that other drivers carry insurance to cover YOU should you be injured as a result of their negligence. This insurance is called Bodily Injury (BI) Coverage. So, what happens if you are hit by another vehicle and require medical care exceeding your $10,000.00 in PIP coverage, or you become unable to work now or in the future, or you are diagnosed with a permanent injury resulting from the crash? If you don’t carry Uninsured/Underinsured Motorist Coverage, your only recourse is to sue the at fault party directly. Let me give you a hint – if the at-fault party has no assets to protect, he won’t carry BI coverage. NO BI coverage is generally a VERY good indicator of an uncollectible judgment. And here you are, suffering because of someone else, through no fault of your own.

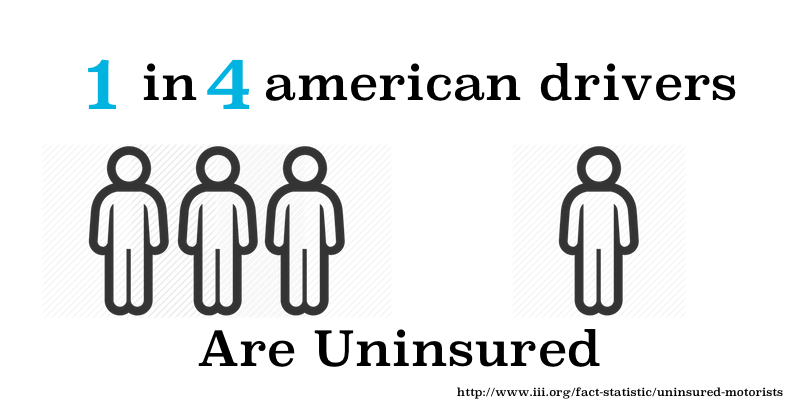

THIS is where UM comes into play. UM is a coverage you purchase on your policy specifically to cover YOU in the case of a crash caused by someone else who either carries no BI coverage, or too little BI coverage to fully reimburse you for your losses. It is a must in Florida – driving without UM on your policy is unwise, no matter the reason. UM coverage costs merely dollars a month to add to your policy. And here is why insurance agents don’t sell it: UM is a money-loser for insurance companies. Low premiums and high payouts. Insurance agents are therefore bonused based on how many UM claims are made through policies sold by that particular agent…the fewer the claims, the higher the bonus.